A) indicate the firm's desire to retain funds.

B) increase the investor's overall wealth.

C) reduce the threat of a takeover by creating more shares.

D) bring the share price to a lower trading range.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation can affect dividend payouts in that:

A) higher interest rates resulting from inflation have left more earnings available for dividends.

B) inflation leads investors to demand higher payouts.

C) corporations are hesitant to pay dividends from inflation-caused "inventory profits."

D) dividend payouts decrease due to slower earnings growth in an inflationary economy.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm may repurchase stock in the market because:

A) it will decrease the shareholder's wealth.

B) the firm has inadequate capital budgeting alternatives.

C) it provides negative informational content.

D) the shareholders want to divest.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

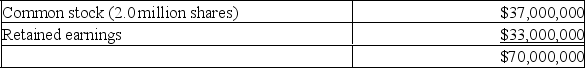

Pharma Duece Corporation, which manufactures biotech drugs, has been experiencing a tremendous growth in the price of its common stock. The stock price increased from $4.50 on January 1, 20X1 to $18.00 per share on December 31, 20X5. Its current net worth statement is as follows:

A) What changes would occur in the above statement of net worth after a 2 for 1 stock split?

B) Earnings for 20X5 were $1,575,000, what would EPS be before and after the stock split?

A) What changes would occur in the above statement of net worth after a 2 for 1 stock split?

B) Earnings for 20X5 were $1,575,000, what would EPS be before and after the stock split?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shareholders may prefer dividends to reinvestment by the firm:

A) because dividends provide the highest return to investors.

B) because dividend payments are tax free.

C) because investors may prefer current cash to future cash.

D) because shareholders may prefer faster growth in the firm.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ex-dividend date is the date on which:

A) recipients of the dividend are determined.

B) the dividend is paid.

C) the dividend is declared.

D) the stock bought no longer includes the right to receive dividend payments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Because the investor is taxed whether dividends are received or not, there are no real advantages to a dividend reinvestment plan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

CBA Inc. has 250,000 shares outstanding. The shares were issued for $14. The stock is currently selling for $34. CBA has $5,000,000 in retained earnings and has declared a stock dividend that will increase the number of outstanding shares by 6%. What will be the common stock account after the stock dividend?

A) $510,000

B) $3,500,000

C) $4,010,000

D) $8,500,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock split is different from a stock dividend due to:

A) delisting by stock exchanges.

B) the resulting change in market price of the common shares.

C) the shares outstanding after the split or dividend will have an increased market value.

D) no transfer of funds from retained earnings to the capital accounts.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Investors in high marginal tax brackets prefer dividends while investors in low marginal tax brackets prefer to have corporate earnings reinvested.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 110 of 110

Related Exams