A) $12,000.

B) $16,100.

C) $17,100.

D) $18,100.

E) $13,600.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Continuous improvement:

A) Encourages employees to maintain established business practices.

B) Strives to preserve acceptable levels of performance.

C) Rejects the notion of "good enough."

D) Is not applicable to most businesses.

E) Is possible only in service businesses.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

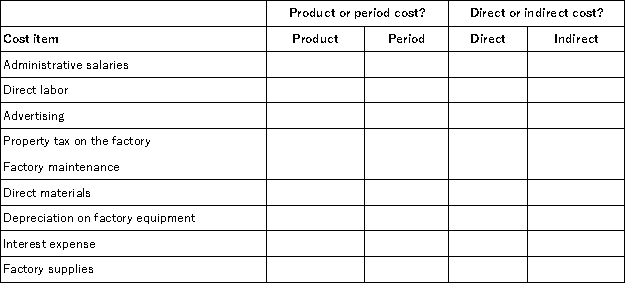

Essay

For each item shown below,classify it as a product cost or a period cost,by placing an X in the appropriate column.For each item that is a product cost,also indicate whether it is a direct cost or an indirect cost with respect to a unit of finished product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items appears only in a manufacturing company's financial statements?

A) Cost of goods sold.

B) Cost of goods manufactured.

C) Goods available for sale.

D) Gross profit.

E) Net income.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information relates to the manufacturing operations of the Abbra Publishing Company for the year:  The raw materials used in manufacturing during the year totaled $1,018,000.Raw materials purchased during the year amount to:

The raw materials used in manufacturing during the year totaled $1,018,000.Raw materials purchased during the year amount to:

A) $955,000.

B) $892,000.

C) $1,565,000.

D) $408,000.

E) $1,081,000.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The main difference between the cost of goods sold of a manufacturer and a merchandiser is that the merchandiser includes cost of goods manufactured rather than cost of goods purchased.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The sales commission incurred based on units of product sold during the month is an example of a product cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The schedule of cost of goods manufactured is divided into four parts consisting of all of the following except:

A) Direct materials.

B) Computation of cost of goods sold.

C) Overhead.

D) Computation of cost of goods manufactured.

E) Direct labor.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding product and period costs?

A) Office salaries expense and factory maintenance are both product costs.

B) Office rent is a product cost and supervisors' salaries expense is a period cost.

C) Factory rent is a product cost and advertising expense is a period cost.

D) Delivery expense is a product cost and indirect materials is a period cost.

E) Sales commissions and indirect labor are both period costs.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

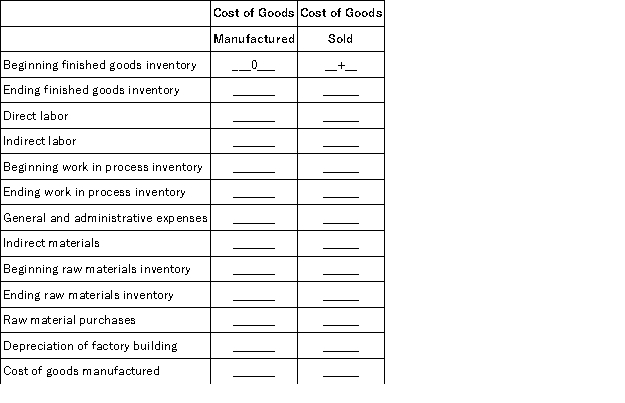

Essay

The following items for Neptune Company are used to compute the cost of goods manufactured and the cost of goods sold.Indicate how each item should be used in the calculations by filling in the blanks with "+" if the item is to be added,"-" if the item is to be subtracted,or "0" if the item is not used in the calculation.The first item is completed as an example.

Correct Answer

verified

Correct Answer

verified

True/False

An employee overstates his reimbursable expenses in one period in order to receive needed additional cash.Since he intends to reduce his expenses the next period by the current overstatement,this act is not considered fraudulent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

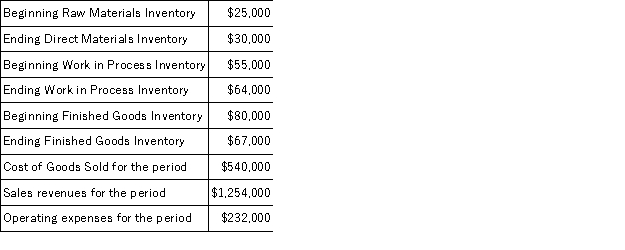

Using the information below,compute the raw materials inventory turnover:

A) 6.76.

B) 6.02.

C) 54.0.

D) 60.6.

E) 6.37.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would appear on a schedule of cost of goods manufactured?

A) Raw materials,factory insurance expired,indirect labor.

B) Raw materials,work in process,finished goods.

C) Direct labor,delivery equipment,and depreciation on factory equipment.

D) Direct materials,indirect labor,sales salaries.

E) Direct labor,factory repairs and maintenance,wages payable.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

_____________________ inventory consists of goods a company acquires to use in making products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Just-in-time manufacturing techniques can be useful in _____________ days' sales in raw materials inventory.

A) keeping constant

B) changing upward

C) adding to

D) lowering

E) increasing

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the information below,calculate gross profit for the period.

A) $714,000.

B) $482,000.

C) $1,022,000.

D) $187,000.

E) $727,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that flow directly to the income statement as expenses are called:

A) Period costs.

B) Product costs.

C) General costs.

D) Balance sheet costs.

E) Capitalized costs.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

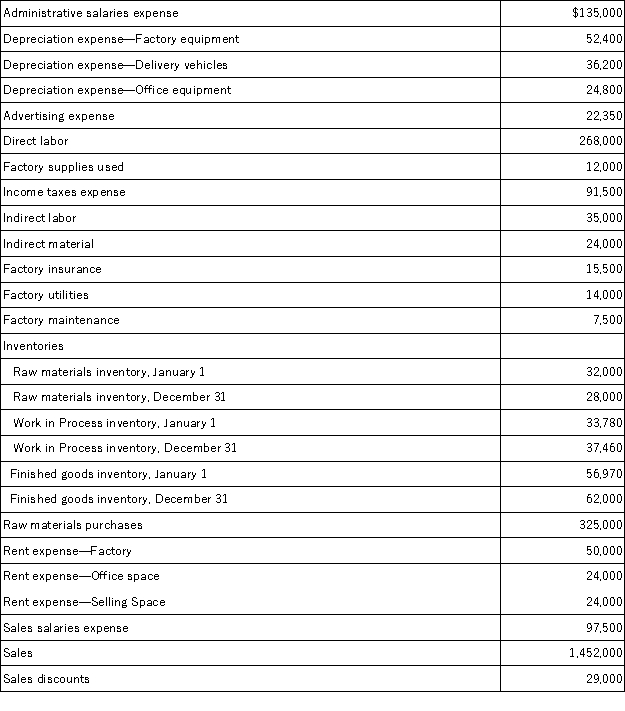

Essay

Information for Jersey Metalworks as of December 31 follows.Prepare (a)the company's schedule of cost of goods manufactured for the year ended December 31; (b)prepare the company's income statement that reports separate categories for selling and general and administrative expenses.

Correct Answer

verified

Correct Answer

verified

Essay

_______________ is the deliberate misuse of the employer's assets for the employee's personal gain.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

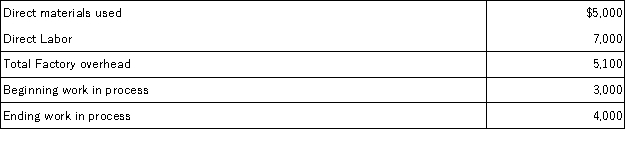

Using the information below for Laurels Company;determine the manufacturing costs added during the current year:

A) $12,000.

B) $16,100.

C) $17,100.

D) $18,100.

E) $13,600.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 205

Related Exams