A) average cost

B) relative sales value

C) fair value

D) amortized cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In no case can "net realizable value" (in the lower of cost and net realizable value rule) be more than

A) estimated selling price in the ordinary course of business.

B) estimated selling price in the ordinary course of business less reasonably predictable

Costs of completion and disposal.

C) estimated selling price in the ordinary course of business less reasonably predictable

Costs of completion and disposal and an allowance for a normal profit margin.

D) estimated selling price in the ordinary course of business less reasonably predictable

Costs of completion and disposal, an allowance for a normal profit margin, and an

Adequate reserve for possible future losses.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an asset is held for sale

A) it must relate to a discontinued operation.

B) the entity must continue to record depreciation for the asset.

C) the asset is remeasured to the lower of carrying (book) value and fair value less costs to

Sell.

D) the asset is remeasured to the lower of fair value and carrying (book) value.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Where there is a significant uncertainty with respect to the measurement of an item,

A) do not record anything in the financial statements.

B) recognize the item in the financial statements and disclose the measurement uncertainty

In the notes to the financial statements.

C) do not record anything in the financial statements but disclose the measurement

Uncertainty in the notes to the financial statements.

D) record the maximum amount in the financial statements.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fudge Ltd.receives a four-year, $100,000 zero-interest bearing note.The present value of this note is $65,873.10.Assuming the note was issued on January 1, 2013, and the effective interest method is used, the interest income to be recognized for calendar 2013 will be

A) $11,000.00.

B) $ 9,000.46.

C) $ 7,246.04.

D) $ 6,587.31.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

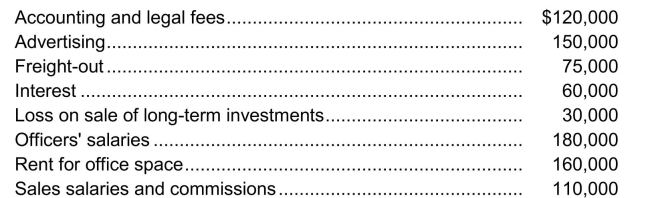

Use the following information for questions Oskar Corp.reports operating expenses in two categories: (1) selling and (2) general and administrative.The adjusted trial balance at December 31, 2014, included the following expense accounts:  One-half of the rented premises is occupied by the sales department.

-How much of the expenses listed above should be included in Oskar's selling expenses for 2014?

One-half of the rented premises is occupied by the sales department.

-How much of the expenses listed above should be included in Oskar's selling expenses for 2014?

A) $260,000

B) $335,000

C) $340,000

D) $415,000

Reporting Financial Performance 4 - 21

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Selling costs are product costs.

B) Manufacturing overhead costs are product costs.

C) Interest costs for routine inventories are product costs.

D) Direct labour costs are usually period costs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions For Pear Limited, events and transactions during 2015 included the following.The tax rate for all items is 30%. 1) Depreciation for 2014 was found to be understated by $30,000. 2) A strike by the employees of a supplier resulted in a loss of $20,000. 3) The inventory at December 31, 2013 was overstated by $40,000. 4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area. -The effect of these events and transactions on 2015 income from continuing operations net of tax would be

A) $14,000.

B) $35,000.

C) $63,000.

D) $294,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, the body that has the final authority over accounting standards is the

A) Financial Accounting Standards Board (FASB) .

B) International Accounting Standards Board (IASB) .

C) Securities Exchange Commission (SEC) .

D) Accounting Standards Oversight Council (AcSOC) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A hardware retailer typically maintains the following inventory account(s) :

A) Merchandise Inventory.

B) Raw Materials and Work in Process only.

C) Raw Materials, Work in Process and Finished Goods.

D) Work in Process and Merchandise Inventory.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For last month, Perma Corp.'s cost of goods sold and ending inventory were $100,000 and $150,000 respectively.Assuming Perma had neither purchases nor returns during the month, what was the cost of its beginning inventory?

A) $50,000

B) $150,000

C) $250,000

D) Cannot be determined from the information given.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The economic entity assumption

A) is inapplicable to unincorporated businesses.

B) recognizes the legal aspects of business organizations.

C) requires periodic income measurement.

D) is applicable to all forms of business organizations.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

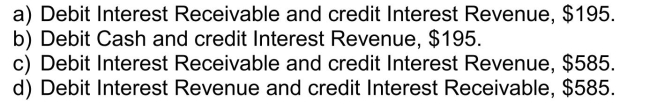

On December 1, 2013, Pink Inc.lent $52,000 to Zinc Inc.in return for a three-month, 4.5% interest-bearing note.What adjusting entry should Pink Inc.make on December 31, 2013, in connection with this note?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of transferring the essential facts and figures from the book of original entry to the ledger accounts is called

A) journalizing.

B) posting.

C) double-entering.

D) adjusting.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The matching principle is best demonstrated by

A) not recognizing any expense unless some revenue is realized.

B) associating effort (expense) with accomplishment (revenue) .

C) recognizing prepaid rent received as revenue.

D) measuring expenses correctly.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes a liability?

A) Any obligation, whether enforceable or not, is a liability.

B) A liability is an enforceable economic burden or obligation.

C) A liability is a legal economic benefit.

D) Deferred income taxes are always shown as liabilities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Sale of receivables without recourse Sparwood Manufacturing factored $250,000 of their accounts receivable to General Factor Corp., on a without recourse basis.The receivables are transferred to General Factor, who takes over the full responsibility of collection.General Factor charged a finance charge of 4% of the dollar value of the receivables, and withheld 5% of the receivable value. Instructions a)Prepare the general journal entry to reflect this transaction on Sparwood's books. b)Prepare the general journal entry to reflect this transaction on General Factor's books.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An accrued revenue can best be described as an amount

A) collected and currently matched with expenses.

B) collected and not currently matched with expenses.

C) not collected and currently matched with expenses.

D) not collected and not currently matched with expenses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a statement of cash flows, proceeds from issuing equity instruments should be classified as cash inflows from

A) lending activities.

B) operating activities.

C) investing activities.

D) financing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

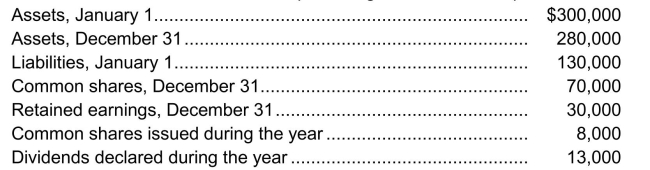

Calculation of net income from the change in shareholders' equity Presented below is selected information pertaining to Pullman Enterprises Ltd.for last year:  Instructions Calculate the net income for last year.

Instructions Calculate the net income for last year.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 505

Related Exams