Filters

Question type

A) $3,300

B) $3,700

C) $2,800

D) $3,800

E) B) and C)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 112

Multiple Choice

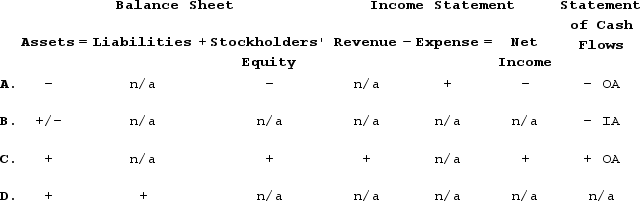

Which of the following represents effects of an asset use transaction on a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

E) None of the above

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 113

Multiple Choice

Expenses are shown on the:

A) income statement

B) balance sheet

C) statement of changes in stockholders' equity

D) the income statement and statement of changes in stockholders' equity

E) C) and D)

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 114

Multiple Choice

Which of the following items appears in the investing activities section of the statement of cash flows?

A) Cash inflow from interest revenue.

B) Cash inflow from the issuance of common stock.

C) Cash outflow for the payment of dividends.

D) Cash outflow for the purchase of land.

E) All of the above

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 204 of 204

Related Exams