A) request other countries to revalue their currency.

B) devalue the peso.

C) allow the peso to appreciate.

D) restricts exports.

E) restrict imports.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deviations from purchasing power parity will be increasingly higher as international trade tariffs become more restrictive. The main reason for this phenomenon is that:

A) arbitrage activities become less profitable.

B) governments prefer purchasing power parity not to hold.

C) the interest rate parity fails to hold.

D) goods become more differentiated across countries.

E) individuals develop hatred toward closed economies.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a U.S. importer needs $22,000 to settle an invoice for 25,520 Swiss francs, the exchange rate must be:

A) 1 Swiss franc = $1.16.

B) 1 Swiss franc = $0.16.

C) 1 Swiss franc = $0.84.

D) $1 = 1.16 Swiss franc.

E) $1 = 1.84 Swiss franc.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The focal point of the Bretton Woods system was the:

A) Great Britain pound.

B) institution of special drawing rights.

C) U.S. dollar.

D) gold reserve.

E) management of commodity money.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a U.S. citizen invests $1,000 to purchase a one-year Japanese bond that has an interest yield of 10 percent. If the dollar appreciates 20 percent against the Japanese yen by the maturity date, the dollar value of the proceeds is _____.

A) $900

B) $1,100

C) $1,300

D) $1,500

E) $1,200

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bretton Woods System of exchange rates was established:

A) to solidify support for the then-existing gold standard.

B) to peg the worldwide price of silver to the price of gold.

C) in Europe before World War II to establish a flexible exchange rate regime.

D) in the United States in 1944 to develop a gold exchange standard.

E) by a mechanism that made gold the reserve currency of the system.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

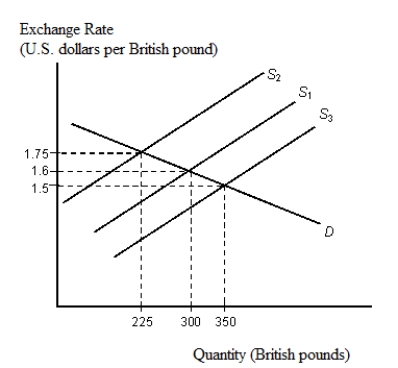

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.

Figure 21.2

-Refer to Figure 21.2. Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3. According to the Bretton Woods agreement:

-Refer to Figure 21.2. Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3. According to the Bretton Woods agreement:

A) the pound should be devalued.

B) the dollar should be devalued.

C) the British central bank should buy pounds in exchange for dollars.

D) the British central bank should encourage speculation.

E) the Fed should intervene to maintain the exchange rate of £1 = $1.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Demand for U.S. dollars by speculators is likely to increase if the dollar is expected to depreciate in the near future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

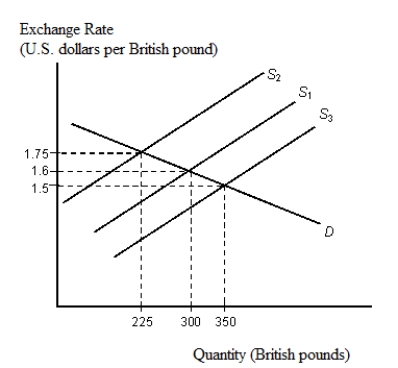

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.

Figure 21.2

-Refer to Figure 21.2. Suppose that the British central bank wishes to maintain a fixed exchange rate of £1 = $1.60. If supply decreases from S1 to S2, the bank must:

-Refer to Figure 21.2. Suppose that the British central bank wishes to maintain a fixed exchange rate of £1 = $1.60. If supply decreases from S1 to S2, the bank must:

A) buy 25 pounds to shift the supply curve from S2 to S1.

B) buy 50 pounds to shift the supply curve from S2 to S1.

C) sell 75 pounds to shift the supply curve from S2 to S1.

D) buy 75 pounds to shift the supply curve from S2 to S1.

E) sell 10 pounds to shift the supply curve from S2 to S1.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following had resulted from the Smithsonian agreement of 1971?

A) Devaluation of the U.S. dollar

B) Dissolution of a fixed exchange rate regime

C) Appreciation of the U.S. dollar

D) Establishment of an equilibrium exchange rate

E) Laissez-faire in the foreign exchange market

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price of an ounce of gold is 200 ZARs in South Africa and $75 in Canada, what will be the South African Rand (ZAR) per Canadian dollar (C$) exchange rate?

A) C$1 = 4.25 ZAR

B) C$1 = 1.75 ZAR

C) C$1 = 2 ZAR

D) C$1 = 2.67 ZAR

E) C$1 = 4 ZAR

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a U.S. investor buys a Mexican bond with a face value of MXP 1,000 and a 20 percent annual interest yield while the exchange rate is MXP 10 per dollar. What is the dollar return from the bond if the exchange rate at the end of the year is MXP 11 per dollar?

A) 9.1%

B) 10.0%

C) 18.2%

D) 20.0%

E) 32.0%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reserve currency is a currency that is:

A) used exclusively to settle domestic debts.

B) specifically designed for use by commercial banks to settle accounts.

C) held only by bureaucrats.

D) used to settle international debts by private corporations.

E) held by governments to facilitate foreign exchange market interventions.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

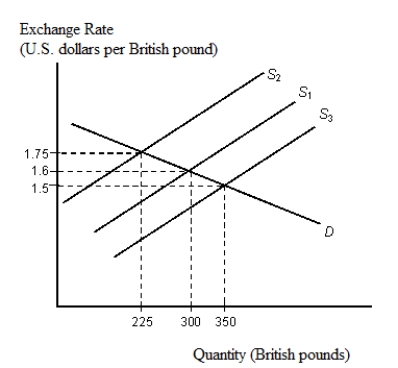

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.

Figure 21.2

-Refer to Figure 21.2. An increase in the equilibrium quantity of British pounds from 300 to 350 would most likely mean that:

-Refer to Figure 21.2. An increase in the equilibrium quantity of British pounds from 300 to 350 would most likely mean that:

A) the demand for British pounds has decreased.

B) the supply of British pounds has decreased.

C) increased demand for dollars has caused the dollar to depreciate and the pound to appreciate.

D) increased demand for dollars has caused the dollar to appreciate and the pound to depreciate.

E) the equilibrium exchange rate is $1.60 per British pound.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The supply of Thai baht in the foreign exchange market originates with:

A) tourists who go on vacation to Thailand.

B) the export of Thailand oranges and other goods.

C) Thai residents who wish to purchase goods from other countries.

D) the Thai royal family.

E) Thai central bank intervention to stop the peseta from depreciating.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Purchasing power parity holds when the exchange rate is equal to the product of the foreign price level and the domestic price level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carlos Silva, a Colombian singer, goes on tour to the United States for one month, following high American demand for his live shows. Assuming that all the show's expenses are paid by the U.S. promoters, other things equal, the U.S. tour will bring about:

A) a decreased supply of Colombian pesos in the foreign exchange market.

B) an increased supply of American dollars in the foreign exchange market.

C) an increased supply of Colombian pesos in the foreign exchange market.

D) a decreased demand for Colombian pesos in the foreign exchange market.

E) an increased demand for American dollars in the foreign exchange market.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $1 was equivalent to 120 Japanese yen in 2008 and 125 Japanese yen in 2010, it implies in 2010, there was:

A) a depreciation of the dollar against the yen.

B) a depreciation of the yen against the dollar.

C) an appreciation of the yen against the dollar.

D) no change in the value of yen, but the dollar had weakened.

E) no change in the value of dollar, but the yen had strengthened.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Appreciation of the dollar means that now it takes more dollars to buy one unit of foreign currency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that a Chrysler automobile sells for $15,000 in the United States and that the exchange rate is $1 = €1.3. For purchasing power parity to hold, the same car should sell in Germany for:

A) €15,000.

B) €11,538.

C) €19,500.

D) €1,538.

E) €15,500.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 132

Related Exams