A) surprising because one would expect that bilateral trade between two countries with flexible exchange rates would be in balance.

B) surprising because the Japanese are high cost producers of many goods that are purchased in large quantities by U.S.consumers.

C) not surprising because there is no reason why bilateral trade between two countries should be in balance.

D) proof that the trade practices of the Japanese are unfair toward the United States.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An appreciation of one's currency means that

A) the country's exports will become less expensive.

B) the country's imports will become more expensive.

C) the country's imports will become less expensive.

D) it now requires more of this currency in exchange for one unit of another currency.

E) it now requires less units of other currencies in exchange for one unit of this currency.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely cause a nation's currency to depreciate?

A) an increase in exports coupled with a decline in imports

B) a slower inflation rate than those of its trading partners

C) lower domestic real interest rates

D) lower real interest rates abroad

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S.dollar appreciates in the foreign exchange market,

A) American goods will become more expensive for foreign buyers and foreign goods will be cheaper for Americans.

B) American goods will become less expensive for foreign buyers and foreign goods will be more expensive for Americans.

C) American goods will become more expensive for foreign buyers and foreign goods will be more expensive for Americans.

D) American goods will become cheaper for foreign buyers and foreign goods will be cheaper for Americans.

E) neither the price of U.S.exports nor the price of U.S.imports will change.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate between the U.S.dollar and the Japanese yen was 1 U.S.dollar equals 125 yen,what would be the price in dollars of Japanese automobiles selling for 2,500,000 yen?

A) $12,500

B) $20,000

C) $25,000

D) $50,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the dollar appreciates,

A) imports to the United States become more expensive for foreigners.

B) exports from the United States become more expensive for foreigners.

C) imports become more expensive for U.S.citizens.

D) exports from the United States become cheaper.

E) the dollar will exchange for fewer units of a foreign currency.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate between the U.S.dollar and the European euro went from $1.20 US = 1 euro to $1.10 US = 1 euro,then

A) European goods have become less expensive for Americans.

B) American goods have become less expensive for Europeans.

C) American exports to Europe are likely to increase.

D) American imports from Europe are likely to decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely cause a nation's currency to appreciate?

A) an increase in inflation of the nation's trading partners

B) an increase in the nation's domestic inflation rate

C) a decrease in domestic real interest rates

D) an increase in real interest rates abroad

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An appreciation in the value of the U.S.dollar would

A) encourage foreigners to make more investments in the United States.

B) encourage U.S.consumers to purchase more foreign-produced goods.

C) increase the number of dollars that could be purchased with the euro.

D) discourage U.S.consumers from traveling abroad.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States is a net importer of capital.This means

A) that U.S.citizens own more foreign assets than foreigners own U.S.assets.

B) that citizens of other countries are buying more U.S.assets than Americans are buying abroad.

C) only that U.S.citizens own foreign assets.

D) only that foreign citizens own U.S.assets.

E) that citizens of other countries are buying fewer U.S.assets than Americans are buying abroad.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

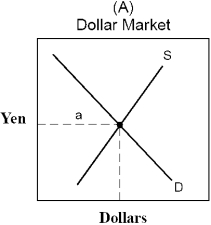

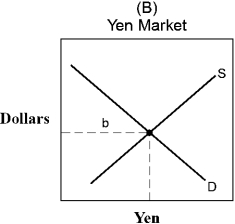

Figure 18-3

-Figure 18-3 displays the international currency market for yen in terms of dollars and dollars in terms of yen.The supply curve in graph (A) is comprised of

-Figure 18-3 displays the international currency market for yen in terms of dollars and dollars in terms of yen.The supply curve in graph (A) is comprised of

A) U.S.citizens attempting to purchase Japanese-made goods.

B) Japanese attempting to purchase U.S.-made goods.

C) U.S.businesses attempting to sell to the Japanese.

D) Japanese businesses attempting to sell to the U.S.

E) the U.S.government attempting to unload dollars to the international market.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If on Tuesday you can buy 125 yen per U.S.dollar and on Wednesday you can buy 120 yen per U.S.dollar,

A) both the U.S.dollar and the yen have appreciated.

B) both the U.S.dollar and the yen have depreciated.

C) the U.S.dollar has appreciated and the yen has depreciated.

D) the U.S.dollar has depreciated and the yen has appreciated.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's trade deficit will tend to expand when

A) its economy is expanding.

B) its economy is shrinking.

C) its investment environment is less attractive to foreigners.

D) both b and c above are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the balance of payments accounts,a net importer of capital is a nation that

A) sells more goods in foreign countries than it imports.

B) must be running a trade surplus.

C) sells more assets to individuals in other countries than the assets it buys from them.

D) buys more assets from individuals in other countries than the assets it sells to them.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An important explanation for the current account deficit and capital account surplus in the United States is that

A) we buy fewer goods from foreigners than they buy from us,and foreigners find the United States an attractive place to invest.

B) we buy more goods from foreigners than they buy from us,and foreigners find the United States an attractive place to invest.

C) we buy fewer goods from foreigners than they buy from us,and Americans find foreign countries an attractive place to invest.

D) we buy more goods from foreigners than they buy from us,and Americans find foreign countries an attractive place to invest.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Would one expect the imports and exports between two countries to be approximately equal?

A) Yes;the foreign exchange rate assures that this will be the case.

B) Yes;this will always be the case unless one of the countries is treating the other unfairly.

C) No;there is no reason to expect that the purchases from and sales to any specific country will be equal because one country may not want to buy the items the other country produces at a low opportunity cost.

D) No;if they were approximately equal this would mean that neither country benefited from the trade.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a flexible exchange rate system,which of the following will be most likely to cause a depreciation in the exchange rate value of the dollar (relative to the English pound) ?

A) An economic boom occurs in England,inducing English consumers to buy more American-made automobiles,trucks,and computer products.

B) Real interest rates in the United States fall lower than real interest rates in England.

C) Restrictive monetary policy in the United States causes inflation to be lower than in England.

D) Attractive investment opportunities in the United States induce English investors to buy stock in U.S.firms.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the United States ran large budget deficits that push the federal debt to dangerously high levels,which of the following would be most likely to occur?

A) An increase in investor confidence,an inflow of capital,and expansion in the size of the trade deficit.

B) Loss of investor confidence,a decline in the net inflow of capital,and shrinkage in the trade deficit.

C) An increase in the attractiveness of investments in the United States,an increase in the inflow of capital,and a smaller trade deficit.

D) An increase in the long-term growth rate of the U.S.economy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With time,a depreciation in the value of a nation's currency in the foreign market will cause the nation's

A) imports to increase and exports to decline.

B) exports to increase and imports to decline.

C) imports and exports to decline.

D) imports and exports to rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a country to successfully maintain a fixed exchange rate value of its currency relative to another currency (for example,as is done when currencies are unified or pegged) ,it must

A) maintain a relatively high rate of inflation.

B) balance the government budget each year.

C) give up the independence of its monetary policy.

D) run a trade deficit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 162

Related Exams