B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interpretations of the rules regarding independence allow an auditor to serve as:

A) a director or officer of an audit client.

B) an underwriter for the sale of a client's securities.

C) a trustee of a client's pension fund.

D) an honorary director for a not-for-profit charitable or religious organization.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sarbanes-Oxley Act ________ a CPA firm from doing both bookkeeping and auditing services for the same public company client.

A) encourages

B) prohibits

C) allows

D) allows on a case-by-case basis

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rule 201 - General Standards requires members to comply with certain standards and interpretations.Which of the following is not a standard specifically addressed in Rule 201?

A) Professional integrity

B) Due professional care

C) Planning and supervision

D) Sufficient relevant data

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies are required to disclose in their proxy statement or annual filings with the SEC the total amount of audit and non-audit fees paid to the audit firm for the two most recent years.Which of the following is not one of the categories of fees that must be disclosed?

A) Tax fees

B) Consulting fees

C) Audit-related fees

D) All other fees

F) A) and B)

Correct Answer

verified

Correct Answer

verified

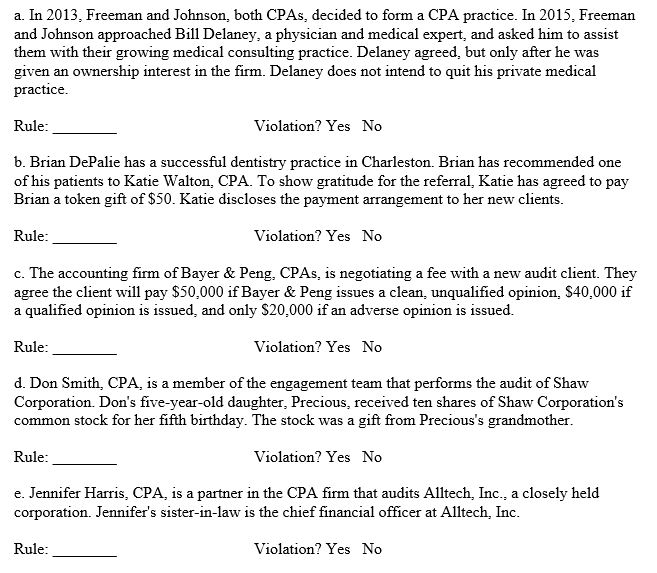

Essay

The following situations involve a possible violation of the AICPA's Code of Professional Conduct.For each situation, (1)determine the applicable rule from the Code, (2)decide whether or not the Code has been violated, and (3)briefly explain how the situation violates (or does not violate)the Code.

Correct Answer

verified

a.Violation of the rule on Form of Organization and Name (Rule 505).Non-CPA ownership of firms is allowable, however, non-CPA owners must actively provide services to the firm's clients as their principal occupation.

b.No violation of the Commissions and Referral Fees rule (Rule 503).A CPA may pay a referral fee to a non-CPA as long as the payment is disclosed to the client.

c.Violation of the Contingent Fees rule (Rule 302).This is a contingent fee agreement and is prohibited by Rule 302.

d.Violation of the Independence rule (Rule 101).Don is a covered member for purposes of Rule 101.Because his daughter is a dependent, her ownership interest in Shaw is treated as a direct financial interest of her father.

e.No violation of the Independence rule (Rule 101).According to the Code a close relative is defined as a parent, sibling, or nondependent child.Thus, a sister-in-law is not considered to be a close relative.

Correct Answer

verified

Multiple Choice

Which of the following circumstances impairs an auditor's independence? I.Litigation by a client against an audit firm claiming a deficiency in the previous audit II.Litigation by a client against an audit firm related to tax services III.Litigation by an audit firm against a client claiming management fraud or deceit

A) I and II

B) I and III

C) II and III

D) I, II, and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A CPA firm:

A) can sell securities to a client for whom they perform an attestation service.

B) can receive a commission for a client that they are engaged to perform an attestation service for.

C) cannot receive a referral fee for recommending the services of another CPA.

D) can receive a commission from a nonattestation client as long as the situation is disclosed.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freedom from ________ means the absence of relationships that might interfere with objectivity or integrity.

A) independence.

B) acts discreditable.

C) impartiality.

D) conflicts of interest.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A CPA firm may practice public accounting only in a form of organization permitted by federal law or regulation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Principles section of the Code of Professional Conduct, all members:

A) should be independent in fact and in appearance at all times.

B) in public practice should be independent in fact and in appearance at all times.

C) in public practice should be independent in fact and in appearance when providing auditing and other attestations services.

D) in public practice should be independent in fact and in appearance when providing auditing, tax, and other attestation services.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

CPAs are prohibited from which of the following forms of advertising?

A) Self-laudatory advertising

B) Celebrity endorsement advertising

C) Use of trade names, such as "Awesome Auditors"

D) Use of phrases, such as "Guaranteed largest tax refunds in town!"

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is(are) true concerning the Ethical Principles of the Code of Professional Conduct? I.They identify ideal conduct. II.They are general ideals and are not enforceable.

A) I only

B) II only

C) I and II

D) Neither I nor II

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is required for a firm to designate itself "Member of the American Institute of Certified Public Accountants" on its letterhead?

A) At least one of the partners must be a member of the AICPA.

B) All partners must be members of the AICPA.

C) The partners whose names appear in the firm name must be members of the AICPA.

D) A majority of the partners must be members of the AICPA.

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following services are allowed by the SEC whenever a CPA also audits the company?

A) Internal audit outsourcing

B) Legal services unrelated to the audit

C) Appraisal or valuation services

D) Services related to assessing the effectiveness of internal control over financial reporting

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining independence with respect to any audit engagement, the ultimate decision as to whether or not the auditor is independent must be made by the:

A) auditor.

B) client.

C) audit committee.

D) public.

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

True/False

Under Rule 505, Form of Organization and Name, a CPA firm may not designate itself as "Members of the American Institute of Certified Public Accountants" unless a majority of its owners are members of the Institute.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The AICPA's Code of Professional Conduct states that a CPA should maintain integrity and objectivity.The term "objectivity" in the Code refers to a CPA's ability to:

A) choose independently between alternate accounting principles and auditing standards.

B) distinguish between accounting practices that are acceptable and those that are not.

C) be unyielding in all matters dealing with auditing procedures.

D) maintain an impartial attitude on matters that come under the CPA's review.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Code of Conduct rule on independence indicates that materiality must be considered when:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following instances would impair a CPA's independence when they have been retained as the auditor? I.A charitable organization where the CPA serves as treasurer II.A municipality where the CPA owns $250,000 of the $25 million outstanding bonds of the municipality III.A company that the CPA's investment club owns a 10% investment interest

A) I and II

B) I and III

C) II and III

D) I, II, and III

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 119

Related Exams