A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) imposes a binding price ceiling in that market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

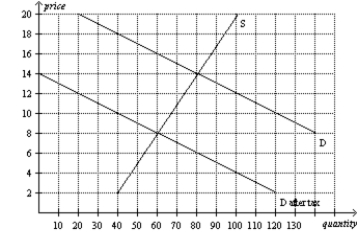

Figure 6-26  -Refer to Figure 6-26. The price paid by buyers after the tax is imposed is

-Refer to Figure 6-26. The price paid by buyers after the tax is imposed is

A) $16.

B) $8.

C) $14.

D) $12.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

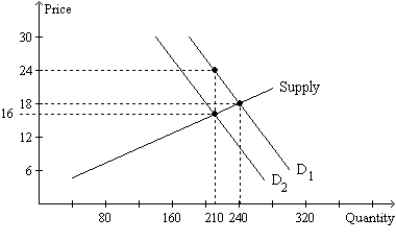

Figure 6-24  -Refer to Figure 6-24. In the after-tax equilibrium, government collects

-Refer to Figure 6-24. In the after-tax equilibrium, government collects

A) $1,440 in tax revenue; of this amount, $960 represents a burden on buyers and $480 represents a burden on sellers.

B) $1,440 in tax revenue; of this amount, $720 represents a burden on buyers and $720 represents a burden on sellers.

C) $1,680 in tax revenue; of this amount, $1,260 represents a burden on buyers and $420 represents a burden on sellers.

D) $1,680 in tax revenue; of this amount, $840 represents a burden on buyers and $840 represents a burden on sellers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

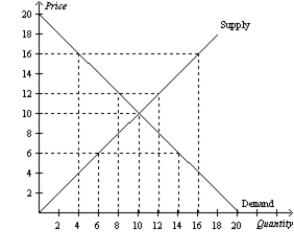

Figure 6-4  -Refer to Figure 6-4. A government-imposed price of $6 in this market is an example of a

-Refer to Figure 6-4. A government-imposed price of $6 in this market is an example of a

A) binding price ceiling that creates a shortage.

B) non-binding price ceiling that creates a shortage.

C) binding price floor that creates a surplus.

D) non-binding price floor that creates a surplus.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 641 - 644 of 644

Related Exams