B) False

Correct Answer

verified

Correct Answer

verified

True/False

The term structure of interest rates is a dynamic function that relates the term to maturity to the yield to maturity of bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Samurai bonds are yen-denominated bonds sold in markets outside Japan by international syndicates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following provisions that may be found in a bond indenture, which would tend to reduce the coupon interest rate?

A) a call provision

B) no restrictive covenants

C) a sinking fund provision

D) change in bond rating from Aaa to Aa

E) an indenture provision

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The market for short-term issues with maturities of one year or less is commonly known as the money market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you have a 12 percent, 20-year bond traded at $850. If it is callable in 5 years at $1,100, what is the bond's yield to call? Interest is paid semiannually.

A) 8 percent

B) 9.0 percent

C) 18.0 percent

D) 9.4 percent

E) 16.5 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 15-year bond, purchased five years ago, has a $1,000 par value bond, a 10 percent coupon, and a yield to maturity of 12 percent. Interest is paid annually. The bond's price is

A) $864.

B) $887.

C) $1152.

D) $1123.

E) $1253.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the price of a zero-coupon bond with yield to maturity of 8.75 percent, a face value of $1000, and maturing in five years.

A) $1000

B) $756.43

C) $675.44

D) $435.12

E) $875.14

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the current price of a zero-coupon bond with a 6 percent yield to maturity that matures in 15 years?

A) $4.17

B) $41.27

C) $417.27

D) $4,172.00

E) $41,720.00

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ measures the expected rate of return of a bond assuming that you sell it prior to its maturity.

A) Yield to maturity

B) Current yield

C) Realized yield

D) Coupon rate

E) None of these are correct.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

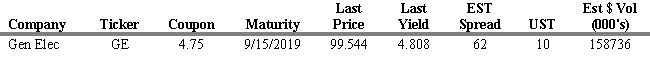

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 12.1. What is the estimated yield on Treasury securities?

-Refer to Exhibit 12.1. What is the estimated yield on Treasury securities?

A) 4.188 percent

B) 5.428 percent

C) 5.371 percent

D) 4.132 percent

E) 4.753 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TIPS are U.S Treasury securities where the coupon rate is

A) zero.

B) indexed to the rate of inflation.

C) indexed to the discount rate.

D) indexed to the prime rate.

E) indexed to the stock market.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The coupon of a bond indicates the income that the bond investor will receive over the life of the bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The yield to call is a more conservative yield measure whenever the price of a callable bond is quoted at a value

A) equal to or greater than par plus one year's interest.

B) equal to par.

C) equal to par less one year's interest.

D) less than par.

E) 5 percent over par.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the yield to maturity for a par value TIPS bond with eight years to maturity is 3 percent, and the yield to maturity of a U.S Treasury note with 8 years is 4.25 percent, this implies that

A) the expected annual rate of inflation over the next eight years is -1.25 percent.

B) the expected annual rate of inflation over the next eight years is 1.25 percent.

C) the expected annual rate of inflation over the next eight years is -2.25 percent.

D) the expected annual rate of inflation over the next eight years is 2.25 percent.

E) the expected annual rate of inflation over the next eight years is 0 percent.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) XLR Corporation just issued a $1,000 par value bond with a 7 percent yield to maturity, twenty years to maturity, with an 8 percent semi-annual coupon rate. -Refer to Exhibit 12.2. If market interest rates rise to 10 percent, what will the price of the XLR Corporate bond be in three years?

A) $832.89

B) $838.07

C) $1097.63

D) $1,102.85

E) $1,191.43

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a bond with a price of $944.44 and a coupon of 8 1/2 percent. What is the current yield?

A) 9.4 percent

B) 6.8 percent

C) 8.6 percent

D) 9.0 percent

E) 11.0 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Junk bonds are high yield bond bonds rated below

A) BBB.

B) BB.

C) B.

D) CCC.

E) CC.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) XLR Corporation just issued a $1,000 par value bond with a 7 percent yield to maturity, twenty years to maturity, with an 8 percent semi-annual coupon rate. -Refer to Exhibit 12.2. If market interest rates are constant, what will the price of the XLR Corporate bond be in three years?

A) $904.29

B) $1,097.63

C) $1,098.50

D) $1,102.85

E) $1,105.62

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A bond's price is determined by the issue's coupon rate, length to maturity, and the prevailing yield in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 138

Related Exams