B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed will most likely halt its quantitative easing program by:

A) increasing the money supply.

B) raising reserve requirements.

C) raising the discount rate.

D) selling assets from its portfolio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inflationary expectations fall:

A) there is a movement down along the Phillips curve.

B) the Phillips curve shifts outward.

C) the Phillips curve shifts inward.

D) there is a movement up along the Phillips curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milton Friedman argued that:

A) people's experiences determine their behavior.

B) people's expectations determine their behavior.

C) people are irrational.

D) in the long run,people's expectations are irrelevant.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Adaptive expectations are formed when people use economic models to predict the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that nominal wages increase 10% and productivity increases 20%.Using the equation for the Phillips curve,inflation is:

A) 10%.

B) 20%.

C) 30%.

D) -10%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

New Keynesian economists critique rational expectations by arguing that short-term wage stickiness is brought about by:

A) the policy ineffectiveness proposition.

B) imperfect information and efficiency wages.

C) competitive markets and inflation.

D) competitive markets and market-clearing wages.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a global economy,a problem with using expansionary fiscal and monetary policies to fix the problems in our country is that they can lead to retaliatory actions by other nations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the equation for the Phillips curve,if nominal wages rise by 8% and labor productivity rises by 5%,then we can expect:

A) prices to drop by 3%.

B) no change in prices.

C) prices to rise by 3%.

D) prices to drop by 5%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The shift outward in the Phillips curve in the 1970s was caused by:

A) the oil supply shocks of the mid-1970s and the rise in inflationary expectations.

B) the fall in the unemployment rate.

C) the fall in the inflation rate.

D) the rise in the trade deficit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy is at the natural rate of unemployment,but it's an election year and expansionary policies are used to reduce the unemployment rate.If inflation now exceeds expected inflation,real wages have _____ and workers will demand _____ in their nominal wages.

A) risen;increases

B) risen;decreases

C) fallen;no changes

D) fallen;increases

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Adjustable-rate mortgages usually have interest rates lower than market rates during the first year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a cost of using fiscal or monetary policy to address a jobless recovery?

A) Expansionary monetary policy may lead to inflation in the long run.

B) Government spending might crowd out spending by consumers and firms.

C) Lower interest rates encourage consumers to increase spending.

D) Cutting taxes and increasing government spending increase the national debt.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accelerating inflation causes nominal wages to rise,shifting the short-run aggregate supply curve to the _____ and the Phillips curve to the _____.

A) right;right

B) left;right

C) right;left

D) left;left

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does NOT describe the natural rate of unemployment?

A) the point where the rates of change in productivity and wages are equal

B) the unemployment rate that exerts inflationary pressures

C) the unemployment rate at which inflation equals expected inflation,resulting in zero price pressures on the economy

D) the point where the rates of change in productivity and wages are equal and the unemployment rate exerts no inflationary pressures

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation can be a problem because it:

A) leads to higher wages.

B) makes it more difficult to pay off debt.

C) can easily become hyperinflation.

D) increases interest rates.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

By paying an efficiency wage,employers give employees an incentive to shirk their duties.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any action that reduces the public's perception of the rate of future inflation will shift the Phillips curve to the left.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Monetized debt occurs when debt is reduced by a cut in the money supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

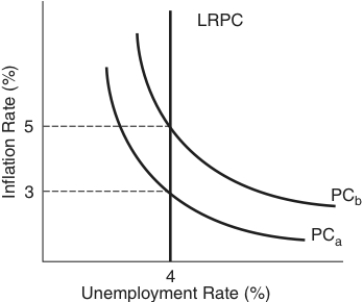

Use the following to answer questions

Figure: Understanding Phillips Curves  -(Figure: Understanding Phillips Curves) What is the natural rate of unemployment associated with Phillips curve PCb?

-(Figure: Understanding Phillips Curves) What is the natural rate of unemployment associated with Phillips curve PCb?

A) zero

B) 3%

C) 4%

D) 5%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 266

Related Exams